Trust Accounting Software for Tax Practitioners

Fee from refund made easy!

Pioneer in Cloud based Trust Management Software for Accounting Firms

7 Days Free Trial. Cancel Anytime.

Integrated with Access Practice Manager (Salesforce) and Xero Practice Manager (XPM)

Why should you invest in a statutory trust accounting software?

Fee From Refund Process Flow

Powerful and User-Friendly Trust Accounting Software for Tax Practitioners

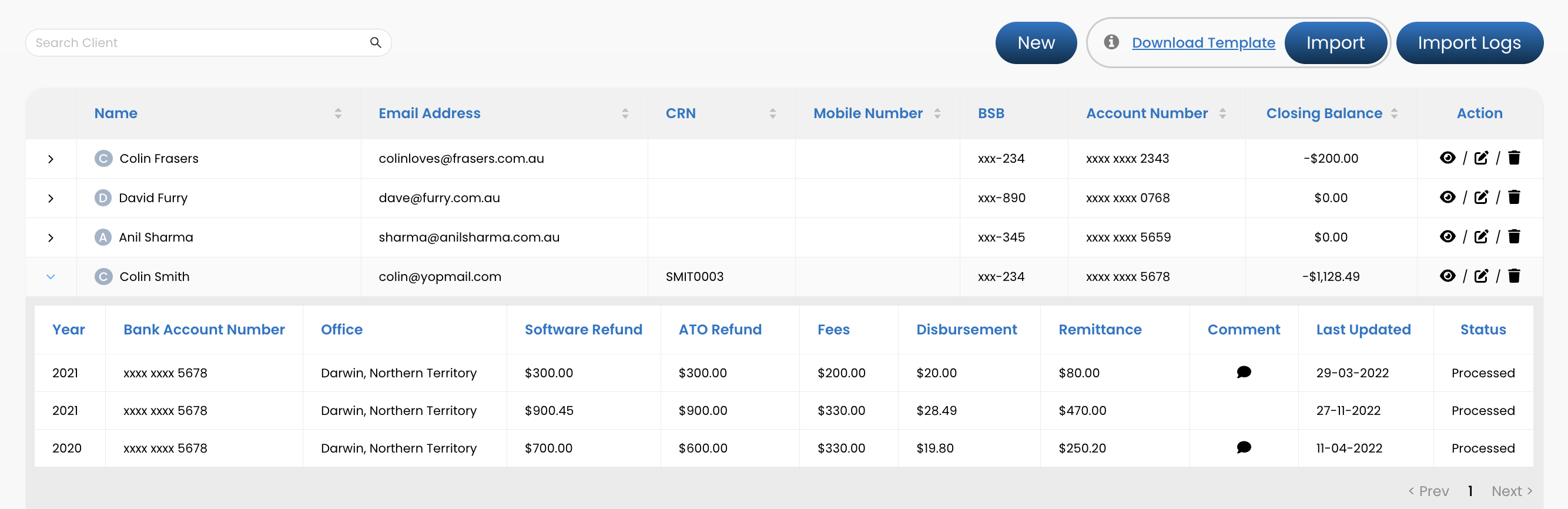

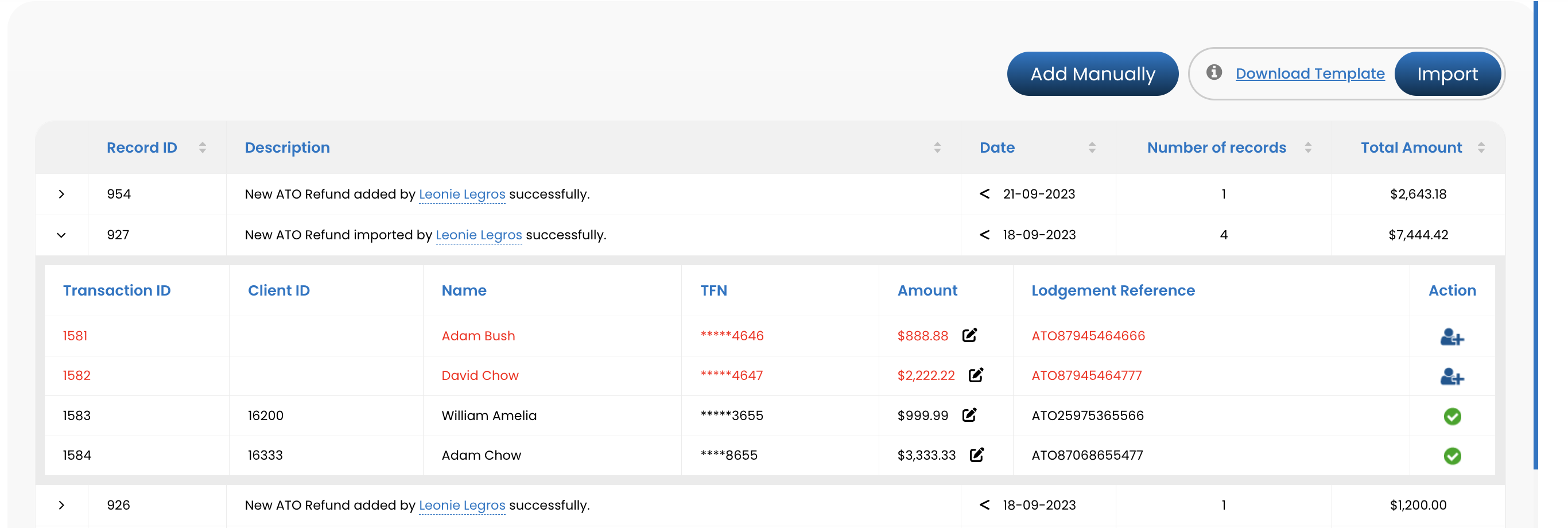

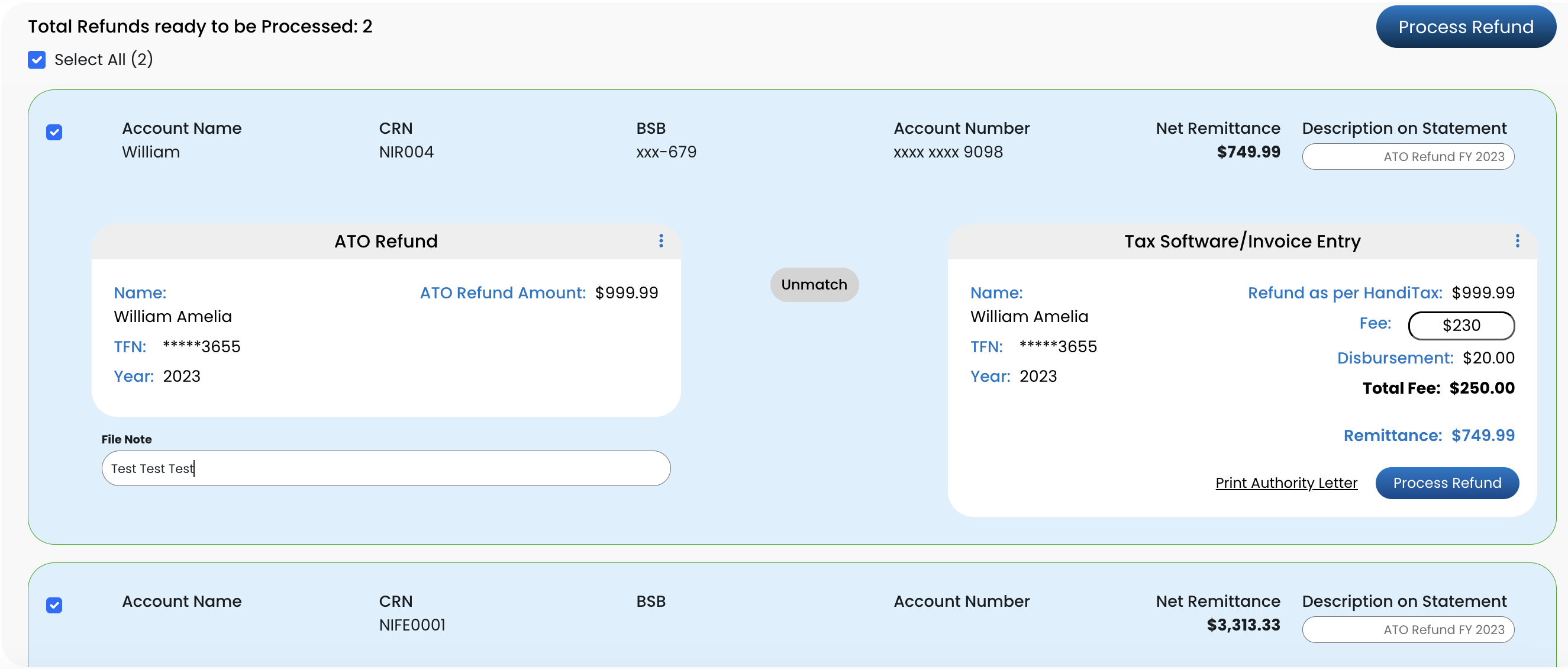

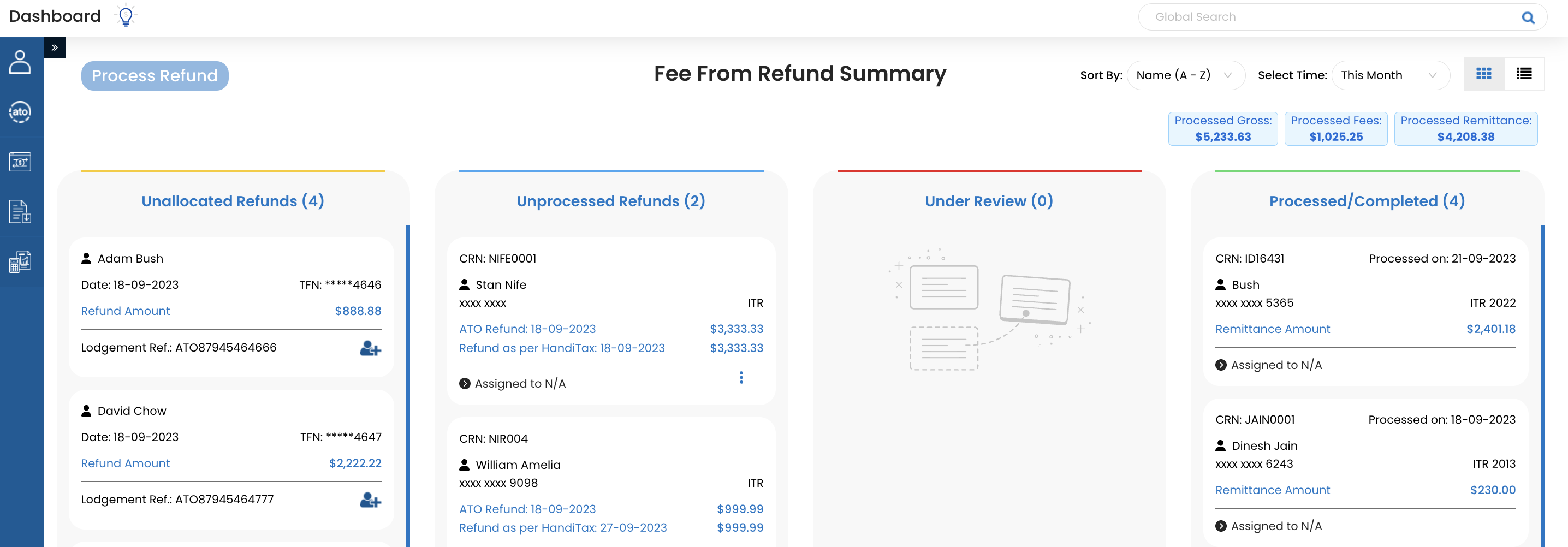

Statutory Trust Accounting for Tax practitioners is used mainly to manage Fee From Refund (FFR). When clients prefer the fee be deducted from the refund from the ATO, Tax Practitioners provide this FFR service by putting their Trust Account details on the tax form.

At TrustEasy, we did research on the best practice, Tax Practitioners Board (TPB) requirements, the ATO requirements and requirements from the Accounting Body (CAANZ, CPA Australia and IPA). We’ve done the hard work so that Tax Practitioners can seamlessly deliver Fee From Refund service and meet other trust accounting requirements.

At TrustEasy, by using our Trust Accounting Software, our mission is to make Tax Practitioners job easy so that they can say no to spreadsheets, outsource “Fee From Refund” work or compromise with any substandard software.

TrustEasy is a cloud based SaaS designed to manage trust accounts for Accounting Firms/Tax Practitioners. Fee From Refund and trust management can be easier, simpler and faster using our Trust Accounting Software and hence we call it TrustEasy.

Why TrustEasy?

- Help you meet CPA Australia, IPA and CAANZ requirements on managing client monies in the Trust Account.

- Meets the Tax Practitioners Board (TPB) Code of Professional Conduct – Holding money or other property on trust.

- Help you meet Australian Taxation Office (ATO) and TPB requirements on Know Your Clients (KYC) for Proof of Id (POI).

- Automatic Bank Feeds and Audit trail to help you meet the bank reconciliation requirements.

- Highly Secured: Multi Factor Authentication (MFA) to login, SHA256 for Encryption, OAuth 2.0 for the integration using APIs.

- Masks Tax File Number and Bank Account Numbers.

- Produce Authority Letter and Receipt as per Accounting Professional & Ethical Standards Board (APESB) requirements.

- Integrated with XPM and Salesforce using Access Accountant Cloud objects (Handisoft) for simple integration.

- Native Cloud with APIs – first in Australia to manage Statutory Trust Account for Accounting Firms.

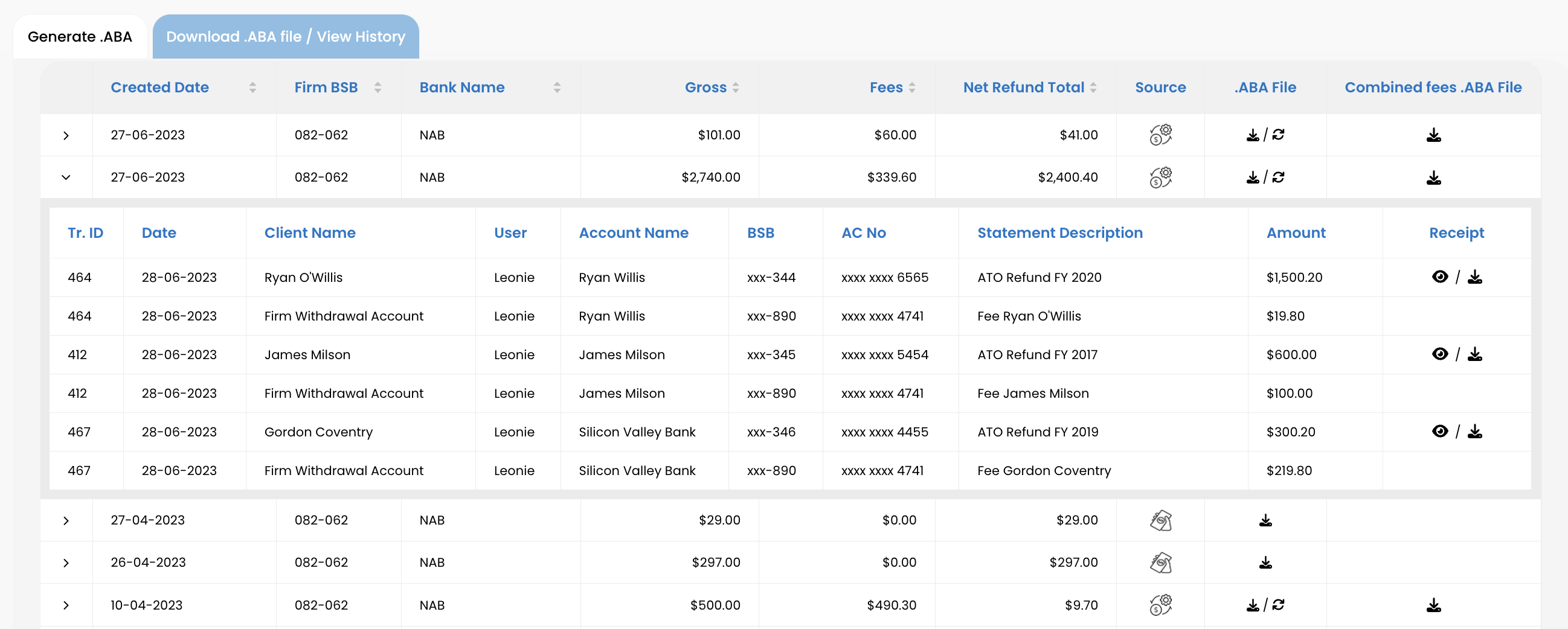

- Generate .Aba files for client’s net refund and Firms professional fee at the same time to pay in bulk to meet the payment within three days requirement.

- Reconcile with the ATO EFT reconciliation report in bulk to manage high volume.

- Dashboard view and filters for total visibility and under review tab for reporting to the Accounting Body.

- Statements and Reports for Auditors.

- Easy to Use to save up to 80% of time.

+61 8 6726 6666

+61 8 6726 6666